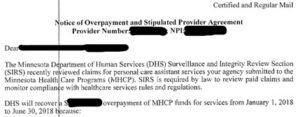

If you are reading this, it is probably because you or your personal care service provider agency (PCA agency) received a Notice of Overpayment,[1] possibly with a Stipulated Provider Agreement,[2] like the one below:

Receiving this overpayment notice will bring two questions immediately to mind:

- What does this mean?

- What are the next steps?

This is the first in a series of articles addressing how a PCA agency can challenge these alleged overpayments and what it takes to do so.

What Does This Mean? Overpayment

You received this notice because the government decided that it would collect an overpayment from you (and usually, force you to sign a Stipulated Provider Agreement). The notice should indicate that the Department of Human Services (DHS) is seeking repayment “because recipient files had insufficient care plans or were missing care plans”. This can also be for issues related to time sheets or Qualified Professional documentation.

As a PCA agency, your services are provided through a program administered by DHS, and you can be subject to regulation by DHS and monetary recovery of payments made to your agency.

Minnesota participates in the Medicaid program,[3] which funds medical assistance (MA)[4] for eligible individuals who are unable to pay for their medical care.[5] DHS is charged with administering and overseeing this program through the Minnesota Health Care Programs (MHCP).[6]

DHS’s Surveillance and Integrity Review Section (SIRS) is charged with investigating and ensuring that all agencies receiving payment from the MHCP comply with state and federal requirements.

SIRS has the authority to identify and investigate “fraud, theft, abuse, or error” related to health services provided through programs administered by DHS. As I will discuss in detail in the next installments of this series, DHS may obtain monetary recovery from any agency who has been improperly paid for services as a result of fraud, theft, or abuse in connection with the provision of medical care, or as a result of error— even if the error was unintentional, and even if it is DHS’s error and not the agency’s error.

What Are The Next Steps?

- Contact an Attorney ASAP: A PCA agency attempting to challenge an overpayment is facing an uphill battle. It is risky to challenge DHS without the aid of counsel who understands this process. It is important to understand that in Minnesota, a corporation can appear only by counsel, including in administrative court. This same rule applies to Limited Liability Corporations (LLCs) and Limited Liability Partnerships (LLPs). Participation by non-attorneys may be fatal to the party’s case. If your agency is a corporation, LLC, or LLP, it must be represented in administrative court by a Minnesota-licensed attorney, or you risk losing your appeal for this reason alone.

- File Your Appeal on Time and in Compliance with the Requirements: You may challenge the notice by filing a written request of appeal and a contested case hearing. This written request must be received by the commissioner no later than 30 days after the date the notification of monetary recovery or sanction was mailed to the vendor.[7] An appeal must be filed in the time and manner that the agency sets—or face automatic dismissal and be stuck with the administrative decision permanently. If the deadline to appeal is missed, there is no next step.

- Don’t Try to Make Peace with DHS: I have seen this scenario play out all too often. A PCA agency receives an overpayment notice; the agency then provides a good-faith response in hopes that it will convince the DHS that the agency is an ethical and honest business; and then the DHS ultimately uses statements and evidence provided with agency’s response to support its overpayment decision.

Final Thoughts

As with so many other businesses defending themselves from fines, punishment, and revocation of licenses, a PCA agency faced with an overpayment has the odds stacked against it. The stakes are too high to fight that battle alone. Please feel free to contact me at (952) 746-2139 or bkenny@hjlawfirm.com if you would like to discuss any issues surrounding overpayments and other aspects of the MHCP.

Stay tuned for the next installments in this series, addressing how PCA agencies can most effectively challenge overpayments.

[1] Because DHS may suspend or terminate a PCA agency from participation in the Minnesota Health Care Programs (MHCP), DHS also issues notices before doing so. [2] A Stipulated Provider Agreement is a document that would impose certain documentation requirements upon a PCA agency that continues to participate in the MHCP and make it easier for DHS to proceed with an enforcement action in the future. [3] See generally 42 U.S.C. § 1396-1396v (2018); Minn. Stat. §§ 256B.01-.85 (2020). [4] See Minn. Stat. § 256B.02, subd. 8. [5] See 42 U.S.C. § 1396-1; 42 C.F.R. § 430.0 (2020). [6] Minn. Stat. § 256B.04; Minn. R. 9505.0011 (2021); see also Minn. Stat. §§ 256B.01-.85; Minn. R. 9505.0295, .0335 (2021). [7] Id., subd. 2(e).